2 Missing Pieces Of Your Marketing Attribution Puzzle

The following is a transcript from the presentation that Abby Sorensen, chief editor at Follow Your Buyer, gave about marketing attribution. It was first presented at the SAMPS Annual Summit on October 24, 2019.

Hello, I’m Abby Sorensen, chief editor at Follow Your Buyer, a B2B marketing resource that’s part of the VertMarkets family. Follow Your Buyer is a method to simplify your marketing so that you really reach the people you actually want to reach. There’s so much information available about content marketing, and Follow Your Buyer is a framework we developed to share the best practices we’ve learned from our nearly 40 years of experience as a B2B publisher.

I recently gave a presentation about marketing attribution at the SAMPS Annual Summit in Philadelphia, and I wanted to share it with the Follow Your Buyer community.

SAMPS stands for Sales and Marketing Professionals in Scientific Research. This presentation includes a case study specific to the life sciences industry, but the concepts can apply to any B2B marketing team dealing with long, complex sales cycles.

As a B2B publisher, we’ve worked with hundreds of companies in life sciences, bio and clinical research, IT, photonic and RF component manufacturing, water and wastewater treatment, retail, healthcare, energy production, and food manufacturing. Regardless of your industry, we know it’s difficult for B2B marketers to measure ROI.

We’re talking about attribution models because of this famous quote: we all want to know which half of our marketing is working.

Yet 30 percent of B2B marketers aren’t even trying to figure out what’s working. And if you don’t know if your marketing is working, then your sales team is going to get all the credit, and you’re not going to have the data you need to fight for more resources.

The best B2B attribution models have two basic things in common.

One, they use a multi-touch model. And two, they track company-wide engagement across multiple contacts.

The first piece of a good attribution model is tracking multiple touches.

Single-touch attribution models are easy. It’s relatively easy to track when a prospect first enters your funnel, or to track the last interaction before a sale.

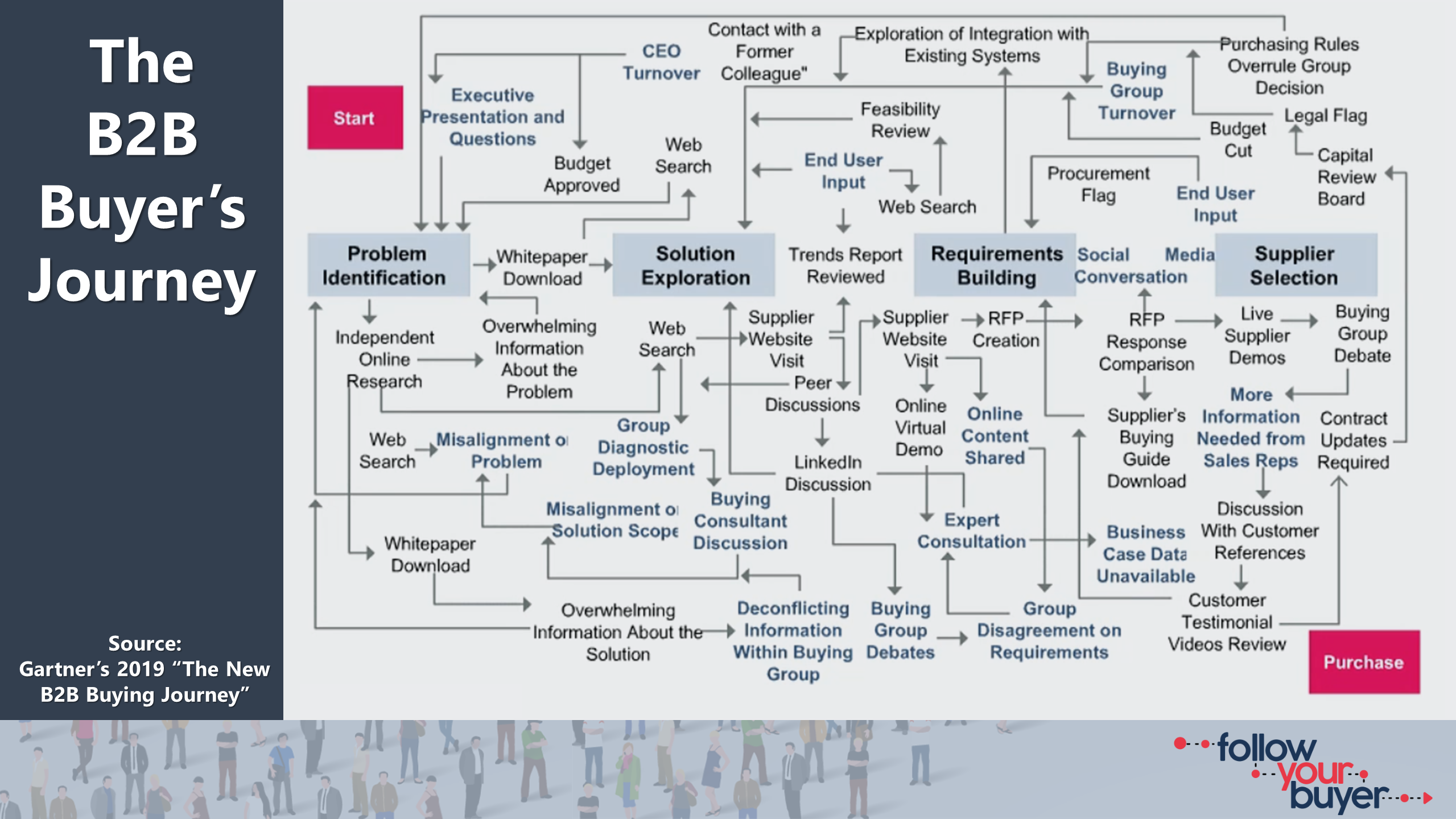

But the purchasing process is not easy for your customers.

Buyer’s journeys are a hot mess, just look at how Gartner depicts the process. There is nothing linear about it.

You can’t even tell where marketing stops and where sales begins. And I’ll explain in another presentation why marketing and sales need to work hand in hand throughout the entire buyer’s journey instead of there being a handoff.

But for now, it’s important to remember 60 percent of this activity happens before a prospect engages directly with a supplier.

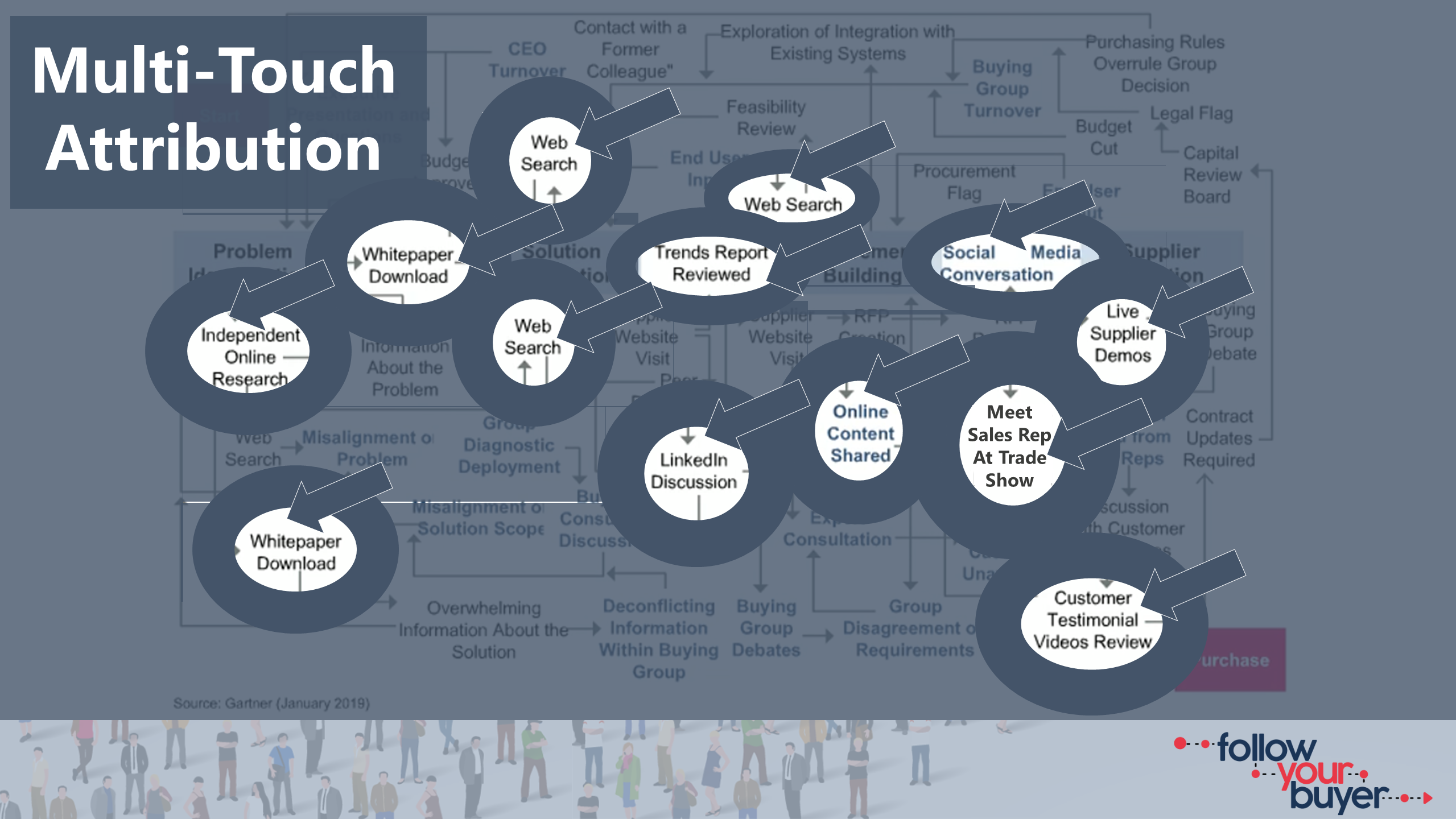

Single-touch attribution models, such as those that only track the last touch before a purchase, can result in decisions based on misleading data.

And you don’t want to dry up your pipeline based on misleading data.

For example, let’s say you use a last-touch model. And you see a trend that contracts tend to get signed after a prospect meets with your sales team at a trade show. That sales rep who worked the booth at the trade show is going to get credit for that contract. Never mind that it was your marketing during the early buyer’s journey that ultimately made that prospect agree to a meeting at the trade show in the first place!

In this example, misleading data is why your sales team would want you to invest more in trade shows and less in every other aspect of marketing.

A side note on single-touch attribution models: the default mode for Google Analytics is a last-touch model. Beware of Google! Google Analytics can be a great, free tool if you’re just starting with attribution. Check out the Multi-Channel Funnels Model Comparison Tool. Just keep in mind that the default mode in this is a last touch model.

A better way to track attribution is to track all activity.

You should track lots of touchpoints, and not necessarily in an order that makes sense.

Based on your typical sales cycle, you can customize how much weight you give to each touchpoint. Don’t worry about getting it perfect. It doesn’t matter if a white paper download is valued at eight percent or 12 percent in your model, what’s more, important is that you track multiple engagements period.

Let me give you an example of how even B2C marketing can get misleading data with single-touch attribution models. Have you ever used a coupon to purchase something you were going to buy anyway? I have. I drink a lot of Diet Coke. I mean a lot. I’m actually drinking one right now while I go through this presentation. As a Diet Coke enthusiast, I love when one of those $1 off coupons is sticking out on the shelf at Target. If Coca-Cola was using a last-touch attribution model, they would give credit to that coupon for my Diet Coke purchase. And that might indicate they should spend less money on branding, product development, and quality control and more money getting coupons in the hands of prospects. That decision could bankrupt them because it wasn’t the coupon that actually made me purchase the Diet Coke.

This might seem like a trivial example. But now apply the dangers of a single-touch attribution model to a multi-million-dollar solution purchase in the life sciences space where the stakes are much higher than a $5 case of Diet Coke.

If we were in the B2C marketing world, my presentation would end here, and you could go forth and measure marketing ROI using a multi-touch attribution system.

In B2B environments, it’s not enough to track multiple touches for each contact.

Gartner research shows the average B2B purchasing group is made up of 6.8 people. Your product or service might involve 5 people or 10 people or 20 people – the exact size of the purchasing group doesn’t matter. What matters is you track all of them.

Case study: why multi-contact attribution matters.

This is based on real data from one of the Life Science Connect publications, ClinicalLeader.com. Again, even if you are not in the life sciences space, this can still apply to you. Just substitute the “contacts” in the next few slides with your ideal customer, and substitute “CRO” with the type of vendor you are.

Thanks to the data we have access to on Clinical Leader.com, we reverse-engineered a sale for this buyer’s journey. In this case, a $2 billion pharma company awarded a multi-million-dollar contract to a CRO for a rare disease phase one clinical trial.

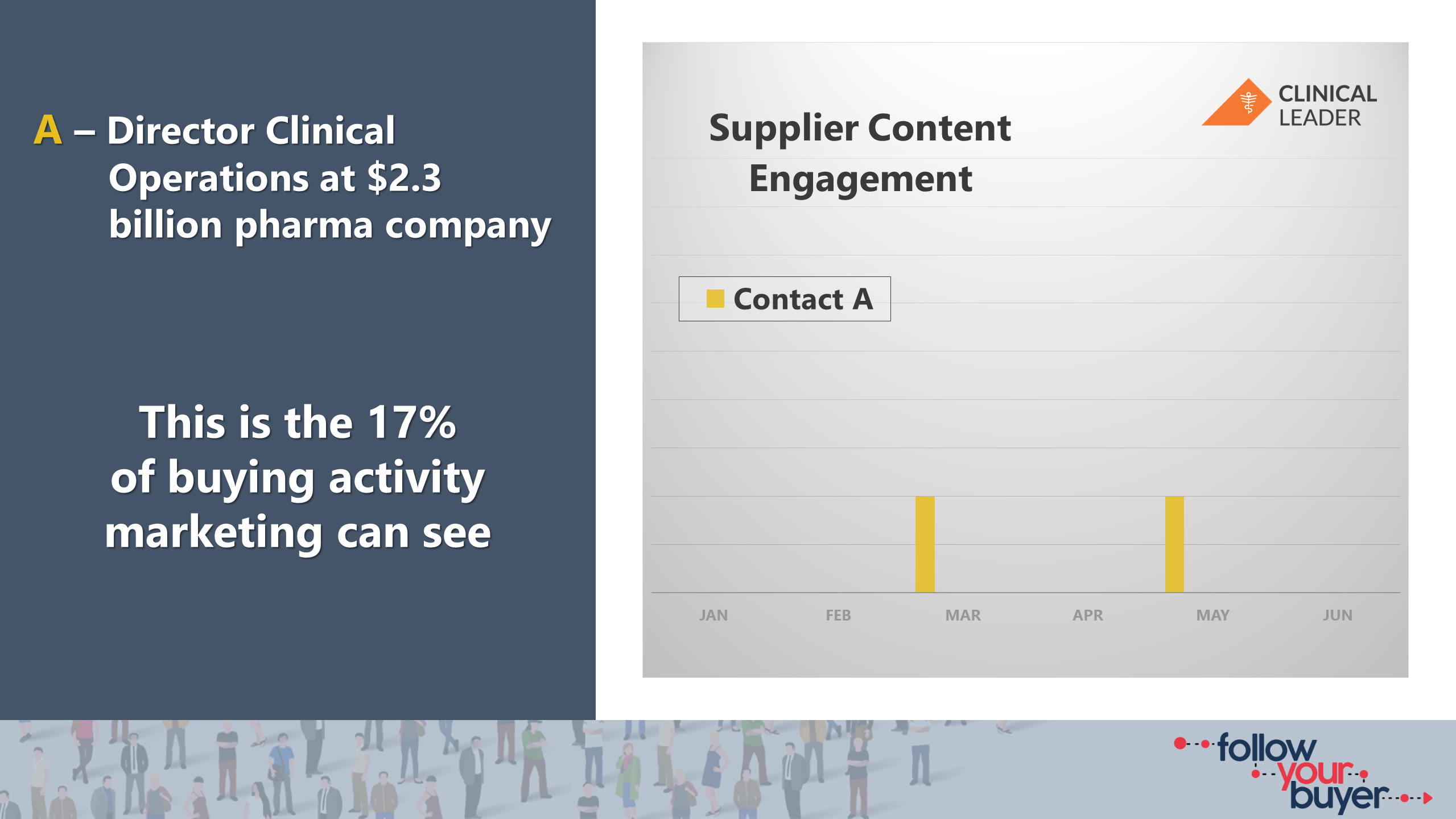

This chart shows a very small part of the attribution puzzle: one person at that pharma company engaging with two pieces of content over a six-month period. This was that person’s only direct engagement with the CRO leading up to that phase one trial.

But nothing about this activity signals this director of clinical operations was an active part of a buying group. This wouldn’t get much credit in a single-contact attribution model. Because here you’re seeing two pieces out of a million missing pieces of the attribution puzzle.

Multi-contact attribution reveals more pieces of the attribution puzzle.

Actually, five contacts engaged with this CRO’s content within that same six-month window. Each of these five people was part of the buying group, including the director of clinical operations from the previous slide.

The yellow bar, that director of clinical operations, isn’t even in the supplier’s CRM because sales never talked to that person. Sales only talked to the orange bar because that was the person who signed the contract.

So that means your marketing efforts get zero credit for those two crucial content interactions represented by that yellow bar.

A single-contact attribution model would have indicated that the yellow bar didn’t play an active role in the purchasing process. But that person absolutely did, and marketing’s content absolutely influenced this buying group’s decision to choose this vendor.

The story of the buyer’s journey doesn’t end there.

This $2 billion pharma company had eight people engage with 65 pieces of content from 13 different suppliers in that same six-month window.

And that’s just the engagement we can see on the Clinical Leader platform. That’s a lot of research going on in a buyer’s journey, and that means more missing pieces in the attribution puzzle.

Most of the research your prospects are doing has nothing to do with you as a supplier.

Let’s look at this new research from Gartner. Their research shows what buying groups actually do with their time.

73 percent of a buying group’s time is spent doing something other than talking to suppliers. That leaves you as the supplier with a small piece of buying group’s attention span.

And keep in mind, you don’t own that entire 17 percent of direct engagement. Let’s say you’re one of 10 suppliers being considered, that means you have less than two percent of the buying group’s attention.

So, you better know what marketing investments captured that two percent of attention so you can get credit for it.

Now, imagine you’re this supplier trying to track attribution. Remember, you can only see a small percentage of activity in a buyer's journey (the activity when a prospect engages directly with you).

Let’s go back to that director of clinical operations at the $2 billion pharma company.

If this person is only engaging with your content twice, you might assume there is minimal involvement in the purchasing decision. Which means your marketing efforts won’t get much credit in this sale.

Look at what else is going on in the buyer's journey.

This director of clinical operations downloaded 23 total pieces of vendor content. Of those 23 engagements, 21 of them were with a competitor.

This director of clinical operations also engaged with 25 pieces of clinical trial editorial content, meaning non-vendor guest articles and feature stories written by our editors about technology and operational aspects of clinical trials.

Without this data, marketing wouldn’t get much credit for this person’s role in the purchase, even though he was highly engaged with the buying group. He just wasn’t engaging directly with the supplier.

There is no such thing as a template for a perfect attribution model.

But if you don't have an attribution model, you can start small.

First, plug in one of the two pieces I just talked about. Start tracking multiple touches and see what the data shows you. Or start looking at multiple contacts within the same company and see what missing pieces you can find.

Second, start doing attribution with a small number of accounts. For example, take five of your top accounts and see if you can reverse engineer a sale just like we did in this short case study. See what the data shows you.

Third, as a marketer who wants to do attribution, you have to start talking to sales. Marketing and sales team must share data if attribution is going to give you actionable, accurate information.

And finally, if you are struggling with attribution, then be mindful of the flaws in your model when you make decisions for next year. Don’t make marketing investments based on misleading data.

There’s no such thing as a perfect attribution model. But make sure you’re not in those 30 percent of B2B marketers who aren’t even trying.

Q&A

Alright, so that was the presentation I gave at the SAMPS Annual Summit. Now I want to quickly run through a few of the questions the audience asked about attribution.

"Should we gate all content on our website so we can track this data?"

I wouldn’t advise that you gate all content. Remember, 60 percent of a buyer’s journey happens before a prospect wants to engage with a vendor. And only 17 percent of a buying group’s time is spent directly interacting with suppliers. So, if you put up lead forms on all of your content, that’s instantly going to turn your prospects off. You want to freely provide helpful content without asking for anything in return – that is how you follow your buyer and build trust with prospects.

“What's the best way to learn who is involved in the purchasing group?”

Well, your prospects aren’t going to disclose that information willingly, even if you ask. Figuring out who those 6.8 people involved in the purchase are is really tough. We have a data analytics team to help determine that. At the very least you can start to gather this information by making sure your CRM has anyone marketing has talked to, even if sales hasn't talked to that person. And vice versa – make sure you hound your sales team to keep account information updated with every new person they talk to.

"How should I respond to criticism when someone in my organization questions the accuracy of our attribution model?"

First, I’d say it’s important to remind your organization that attribution models are not an exact science – no matter what fancy, expensive attribution algorithms and software tools say. Attribution is a moving target, and you should always adapt your model as your customers’ buying habits change. Second, I’d say don't change your model based on a whim or when the first sign of adversity shows up. Give it a month or a quarter to see what the data tells you. Then, if you make an adjustment that results in illogical data, take some time to map this out manually, without a fancy algorithm. And finally, remind any critics that 30 percent of B2B marketers aren't even trying, which means you’re on the cutting edge of trying to measure marketing ROI.

Alright, that’s it for this presentation about marketing attribution models. Of course, if you have more questions about attribution, you can shoot me an email. Or, if you are a B2B marketer who is really passionate about attribution, get in touch and let me write a case study about you.

Again, I’m Abby Sorensen, chief editor of Follow Your Buyer.com. This is the part where I give my shameless plug for the Follow Your Buyer newsletter, a weekly resource with original content about content marketing, plus advice for B2B marketers curated from around the web. You can sign up for it at FollowYourBuyer.com. Thanks for listening!

Originally posted on Follow Your Buyer on 9/30/20

Let's work together.

Whether you're ready to hit the ground running or just starting and have questions, we're here to understand your goals and explore how we can help you.