Leads Aren’t Buyers: Why CDMOs Need To Track Companywide Engagement

Many life sciences marketers are obsessed with leads. The problem is, business development teams can’t sell to a lead.

Pharma companies have long, complex buyer's journeys when it comes to selecting an outsourcing partner. And any good CDMO business development professional knows this, and knows the importance of influencing multiple stakeholders within buying groups.

Yet marketers obsess over tracking lead activity, which is relatively easy to measure. A lead can click a link in an email, download a white paper, or visit your booth at a trade show. A lead can be nurtured and automated and scored.

Marketers need to remember that a lead doesn’t have the power to do much of anything, even if that lead has a C-level title. That’s because there are an average of 6.8 “leads” involved in a buying group. In the CDMO world, that number is likely higher, especially when dealing with large pharma (and even CEOs at emerging biotechs rarely make outsourcing decisions in a total vacuum).

Research from CEB/Gartner shows this number will only continue to grow across all B2B purchases. As outsourcing decisions continue to be made virtually while travel is mostly grounded due to COVID-19, this will only increase the likelihood that the buying group will grow in

It’s time to stop obsessing over individual leads and start looking at the entire picture of a pharma company's buyer’s journey. Yes, this is difficult. But it’s absolutely imperative if you want to be a successful marketer in today’s competitive CDMO sales environment.

Individual Leads Can’t Show A Buyer’s Journey

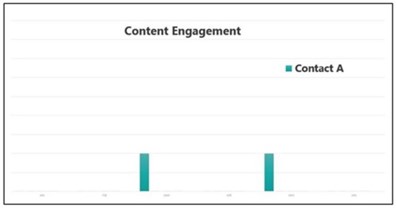

Let’s get to the data. Here’s an example of what a “lead” looks like. This is a reader on the Life Science Connect platform.

This “lead” downloaded two pieces of content within a six-month window. The reader was a director-level title at a $2 billion pharma company that was an ideal target for this supplier.

Two content engagements in six months aren’t very exciting, right? That marketing team had no reason to enthusiastically passed this to sales with “URGENT” in the subject line and one of those red exclamation points to signal it was of “high importance.”

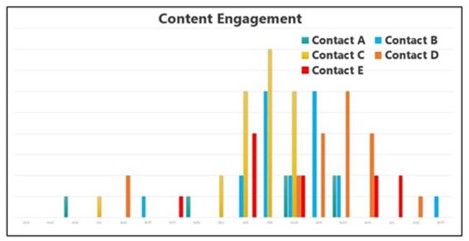

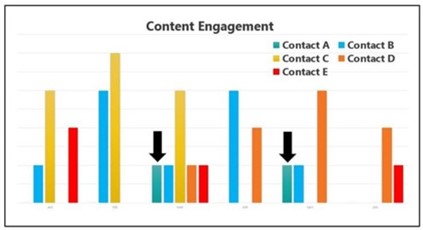

But consider how that lead fits in this view of engagement. This rudimentary chart shows engagement activity from a group of stakeholders at that same $2 billion pharma company.

Now how does that director with two downloads in six months look? Like part of a buying group with an active buyer’s journey, that’s how.

Even though that presumably not-so-engaged lead is showing less activity than those other four colleagues, it’s likely a safe bet that sales should engage that lead and try to determine the fit within the buyer’s journey.

Once you start tracking companywide engagement, you can zoom out even further.

Now look at engagement activity for these same five contacts at this $2 billion pharma company over an 18-month period instead of just a six-month period. These spikes in activity might signal the start of a buyer’s journey.

B2B buyers at pharma companies are humans. And humans are creatures of habit who attend the same trade shows, read the same sources of information, and do so with the same frequency. It’s likely a sign that something is changing when engagement spikes across multiple stakeholders.

Pharma companies aren’t going to give away insight by going to your website, downloading a case study, and sending an email to a sales rep with precise details about their project, budget, and buying group dynamics. But they do have a digital body language that can illuminate the buyer’s journey when you consider companywide engagement rather than a single person's content consumption activity.

Companywide Data Differentiates Interest And Intent

“But our marketing processes aren’t set up to do anything other than discover leads and nurture them until they’re ready to be passed on to sales.” That's something we hear quite a bit.

That’s understandable – many B2B marketers obsess about leads, leads, and more leads, and they have very expensive marketing software platforms to feed these leads into.

If marketers are too transfixed by individual leads, they run the risk of sending the wrong opportunities to their sales teams.

For example, an individual lead can look like an ideal opportunity.

This lead, a CEO of an emerging biotech company (company “A”), was highly engaged. This CEO had 90 content engagements within a six-month window. From a lead-scoring standpoint, it looks like a no-brainer for sales. But this lead is showing interest, not purchase intent.

The difference may seem subtle, but intent leads to fruitful sales opportunities while interest leads to frustrated sales reps.

A lead might be interested and therefore highly engaged for a number of reasons. Maybe this CEO is hoping to merge with another biotech and is doing research on the industry to learn more. Maybe that CEO is interested in raising a round of capital and is doing research to prepare to pitch investors. Or maybe your marketing team writes really interesting article titles and email subject lines that this CEO likes to click on. Even though this CEO from emerging biotech company “A” had 90 engagements in a six-month window, this likely isn’t a sales winnable lead.

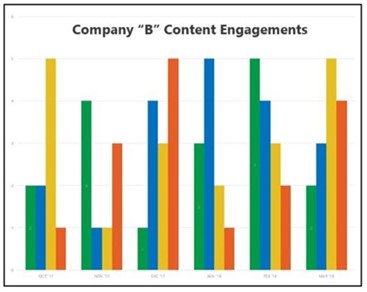

When a group of leads from the same company all start to demonstrate interest, that is often a better indicator of intent.

Company “B” is also an emerging biotech, one with a very similar profile to company “A.” In that same six-month period, four contacts from company “B” had 71 total content engagements. That’s likely a better signal of a purchasing committee with intent to buy.

But if each of those four contacts at company “B” were evaluated as individual leads, they wouldn’t show enough engagement to be passed along to sales.

Biotech “A” averages 15 engagements per lead per month, while biotech “B” averages just shy of 3 engagements per lead per month. See the problem?

Necessary Complexity In CDMO Marketing

Jon Miller, cofounder and former CMO at Marketo, explains, “Lead-only systems struggle to make sense of where the broader account is in the buying journey, which makes it hard to deliver the right experience for each persona and buying stage.” He explains how lead-focused marketing processes create “unnecessary complexity.”

It is complex to track companywide data, but that is now a necessary complexity for CDMO marketers. Any media partner or marketing channel you work with should be able to show you data for multiple people across multiple periods of time. If not, you'll never be able to identify which pharma companies are truly searching for outsourcing partners versus which ones are just surfing for general information.

Originally published on Follow Your Buyer

Let's work together.

Whether you're ready to hit the ground running or just starting and have questions, we're here to understand your goals and explore how we can help you.