Why Multi-Contact Attribution Matters

Thanks to the data we have access to on Clinical Leader, we reverse-engineered a sale for this buyer’s journey. In this case, a $2 billion pharma company awarded a multi-million-dollar contract to a CRO for a rare disease phase one clinical trial.

Single-contact attribution only reveals a part of the attribution puzzle.

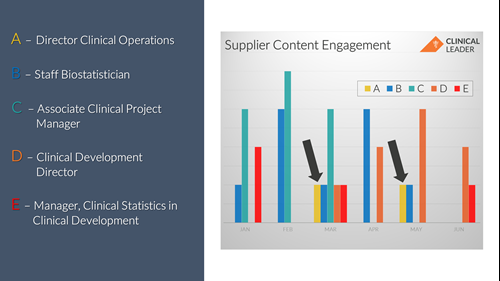

This chart shows a very small part of the attribution puzzle: one person at that pharma company engaging with two pieces of content over a six-month period. This was that person’s only direct engagement with the CRO leading up to that phase one trial.

But nothing about this activity signals this director of clinical operations was an active part of a buying group. This wouldn’t get much credit in a single-contact attribution model - it's just two pieces out of a million missing pieces of the attribution puzzle.

Multi-contact attribution reveals more pieces of the puzzle.

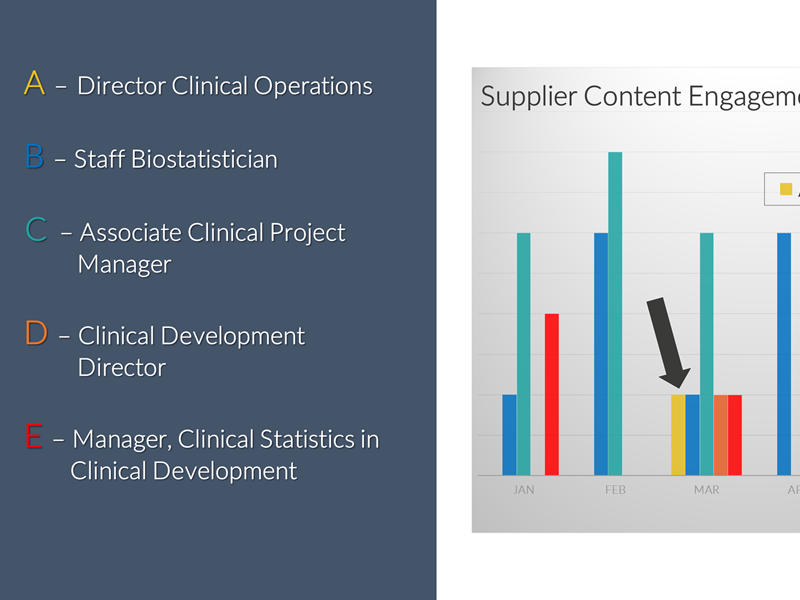

Actually, five contacts engaged with this CRO’s content within that same six-month window. Each of these five people was part of the buying group, including the director of clinical operations.

The yellow bar, that director of clinical operations, isn’t even in the supplier’s CRM because sales never talked to that person. Sales only talked to the orange bar because that was the person who signed the contract.

So that means your marketing efforts get zero credit for those two crucial content interactions represented by that yellow bar.

A single-contact attribution model would have indicated that the yellow bar didn’t play an active role in the purchasing process. But that person absolutely did, and marketing’s content absolutely influenced this buying group’s decision to choose this vendor.

The story of the buyer’s journey doesn’t end there.

The information available in Templeton, our data platform, shows us that this company had eight people engage with 65 pieces of content from 13 different suppliers in that same six-month window.

And that’s just the engagement we can see on the Clinical Leader platform. That’s a lot of research going on in a buyer’s journey, and that means more missing pieces in the attribution puzzle.

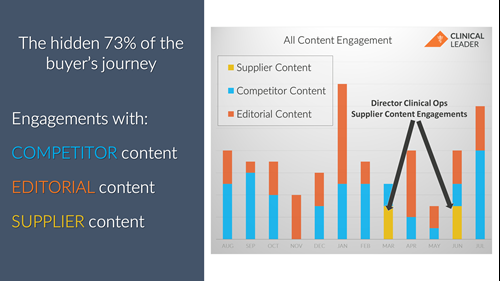

Most of the research your prospects are doing has nothing to do with you as a supplier.

Gartner research tells us that 73 percent of a buying group’s time is spent doing something other than talking to suppliers. That leaves you as the supplier with a small piece of buying group’s attention span.

And keep in mind, you don’t own that entire 17 percent of direct engagement. Let’s say you’re one of 10 suppliers being considered, which means you have less than two percent of the buying group’s attention.

So, you better know what marketing investments captured that two percent of attention so you can get credit for it.

Now, imagine you’re this supplier trying to track attribution. Remember, you can only see a small percentage of activity in a buyer's journey (the activity when a prospect engages directly with you).

Let’s go back to that director of clinical operations at the $2 billion pharma company.

If this person is only engaging with your content twice, you might assume there is minimal involvement in the purchasing decision. This means your marketing efforts won’t get much credit in this sale.

Look at what else is going on in the buyer's journey.

This director of clinical operations downloaded 23 total pieces of vendor content. Of those 23 engagements, 21 of them were with a competitor.

This director of clinical operations also engaged with 25 pieces of clinical trial editorial content, meaning non-vendor guest articles and feature stories written by our editors about technology and operational aspects of clinical trials.

Without this data, marketing wouldn’t get much credit for this person’s role in the purchase, even though he was highly engaged with the buying group. He just wasn’t engaging directly with the supplier.

There is no such thing as a template for a perfect attribution model.

But if you don't have an attribution model, you can start small.

First, plug-in one of the two pieces I just talked about. Start tracking multiple touches and see what the data shows you. Or start looking at multiple contacts within the same company and see what missing pieces you can find.

Second, start doing attribution with a small number of accounts. For example, take five of your top accounts and see if you can reverse engineer a sale just like we did in this short case study. See what the data shows you.

Third, as a marketer who wants to do attribution, you have to start talking to sales. Marketing and sales teams must share data if attribution is going to give you actionable, accurate information.

And finally, if you are struggling with attribution, then be mindful of the flaws in your model when you make decisions for next year. Don’t make marketing investments based on misleading data.

There’s no such thing as a perfect attribution model. But make sure you’re not in those 30 percent of B2B marketers who aren’t even trying.

Let's work together.

Whether you're ready to hit the ground running or just starting and have questions, we're here to understand your goals and explore how we can help you.